Life can throw surprises when you least expect it – a medical bill, a car repair, or even just making it to your next paycheck. That’s when a $200 payday instant loan can come to the rescue. It’s a quick, convenient way to borrow a small amount of money and get it fast – sometimes within minutes.

In this guide, you’ll learn everything about $200 payday instant loans, from how they work to who they’re for, the best apps to use, and how to stay financially safe while borrowing.

What Is a $200 Payday Instant Loan?

A $200 payday instant loan is a short-term loan designed to help you cover urgent expenses until your next payday. It’s called “instant” because many lenders or apps can transfer the funds to your account quickly – often the same day or even within hours.

How Does It Work?

You borrow $200 from a lender or app and agree to pay it back by your next payday. Usually, the repayment is automatically withdrawn from your account.

Is It Really Instant? What to Expect

Most payday loan providers offer fast funding, especially if you apply during business hours. Some apps can even send the cash within minutes if you use a debit card for delivery.

Who Should Consider a $200 Payday Loan?

These loans are meant for short-term financial emergencies – not long-term solutions.

Emergency Situations That Qualify

- Sudden car breakdown

- Overdue utility bills

- Emergency travel

- Prescription costs

Borrowing Responsibly – Things to Consider

Only borrow what you can repay. Late payments can lead to rollover fees or additional debt.

Top Ways to Get $200 Instantly Online

Instant Payday Lenders

These are licensed lenders that offer small-dollar loans online. They may ask for basic documents but usually don’t do hard credit checks.

Cash Advance Apps That Work

Some of the best apps provide cash advances without charging high fees. These apps are great if you want to avoid traditional payday loan traps.

Borrowing $200 with No Credit Check

Many payday lenders and cash advance apps skip the hard credit check and instead look at your income and bank activity.

Prepaid Cards and Early Direct Deposit

Apps that offer early direct deposit allow you to access your paycheck up to 2 days early, giving you the extra $200 you need sooner.

Best Apps for $200 Instant Cash Advances

Here are a few trusted apps that offer $200 cash advance options:

App #1 – Earnin

- Advance up to $750

- No fees or interest

- Tip-based model

- Requires consistent paycheck and bank account

App #2 – Dave

- Borrow up to $500

- $1 monthly subscription

- Instant transfer with a small fee

App #3 – Brigit

- Up to $250 cash advance

- No interest or tips

- Financial tools included

App #4 – MoneyLion

- Up to $500 with no interest

- Instant cash with RoarMoney account

- Credit builder loans also available

Borrow $200 Instantly – What You’ll Need

Eligibility Criteria

- Be at least 18 years old

- Have a valid ID

- Steady income or paychecks

- Active checking account

Required Documents

- Proof of income (pay stub or bank statement)

- Valid photo ID

- Bank account routing and account number

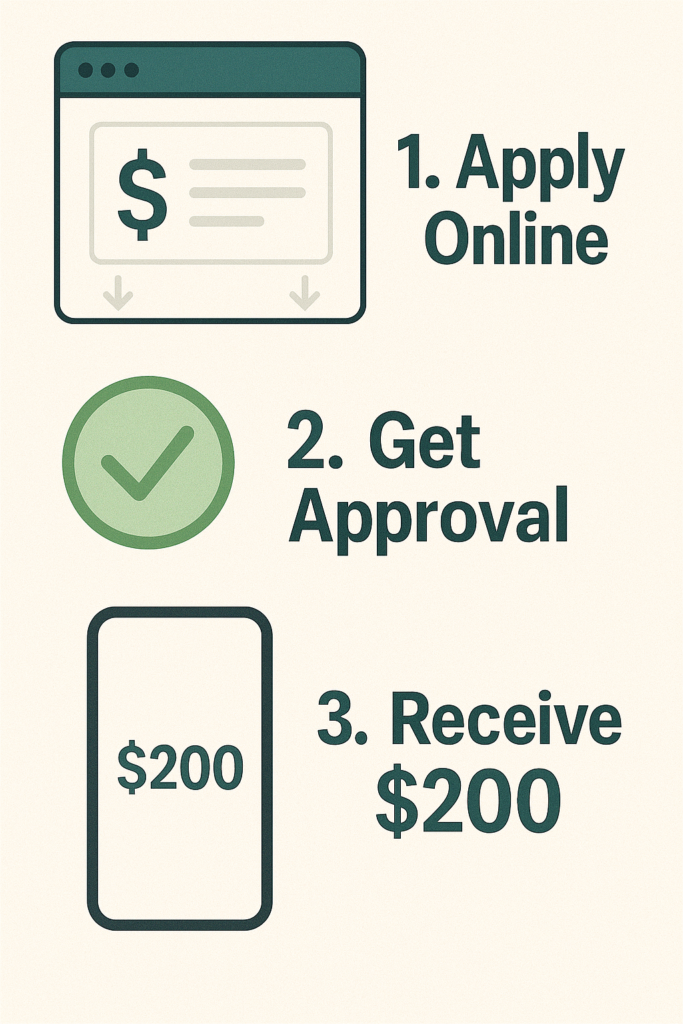

How to Apply in Minutes

Most apps or websites have user-friendly platforms. Just sign up, upload documents, link your bank account, and wait for approval.

Pros and Cons of 200 Dollar Cash Advances

The Upside – Speed, Simplicity, No Hard Pull

- Instant or same-day funding

- Easy application process

- No hard credit checks

The Risks – Fees, Short Repayment, Debt Cycles

- High APRs with traditional payday loans

- Short repayment period (typically 2 weeks)

- Risk of getting stuck in a cycle if not repaid on time

Alternatives to a $200 Payday Instant Loan

Small Personal Loans

Local credit unions or online platforms may offer small loans with better terms.

Peer-to-Peer Lending

Borrow from other individuals through sites like LendingClub or Prosper.

Credit Union Quick Loans

Many credit unions offer small emergency loans with lower rates and longer terms.

Family or Friends (Handled Smartly)

Borrowing from loved ones can be interest-free – just make sure to put terms in writing to avoid misunderstandings.

How to Borrow Smart and Avoid Payday Loan Traps

Look for Transparent Terms

Read the loan agreement carefully. Understand the fees, interest, and repayment dates.

Understand the Repayment Timeline

Know exactly when the money will be pulled from your account.

Plan Ahead to Avoid Rollover Fees

Don’t borrow unless you’re confident you can repay on time. Avoid extending the loan, which leads to more fees.

FAQs About Getting $200 Instantly

Can I Get a $200 Payday Loan with Bad Credit?

Yes! Most payday lenders and cash advance apps don’t require a high credit score.

How Fast Is the Money Deposited?

Some apps send funds in minutes. Others may take 1 business day, depending on your bank.

Will It Affect My Credit Score?

Usually no. As long as you repay on time, most of these services don’t report to credit bureaus.

Final Thoughts – Should You Go for an Instant $200 Payday Loan?

A $200 payday instant loan can be a lifesaver in emergencies. But it’s crucial to borrow wisely, understand the terms, and explore other options if you can. If you’re careful and responsible, this short-term solution can help you get through tough times without long-term trouble.

Last modified: April 20, 2025